Top Guidelines Of Palau Chamber Of Commerce

Wiki Article

Palau Chamber Of Commerce Fundamentals Explained

Table of ContentsThe smart Trick of Palau Chamber Of Commerce That Nobody is DiscussingGetting My Palau Chamber Of Commerce To WorkThe Main Principles Of Palau Chamber Of Commerce The Palau Chamber Of Commerce PDFsHow Palau Chamber Of Commerce can Save You Time, Stress, and Money.Palau Chamber Of Commerce Fundamentals ExplainedThe Ultimate Guide To Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For Everyone

To read more, look into our write-up that talks even more comprehensive regarding the major not-for-profit financing resources. 9. 7 Crowdfunding Crowdfunding has become one of the crucial methods to fundraise in 2021. Consequently, not-for-profit crowdfunding is getting the eyeballs these days. It can be used for details programs within the company or a basic donation to the cause.During this step, you could want to think of milestones that will certainly show an opportunity to scale your not-for-profit. Once you've run for a little bit, it's essential to take some time to think of concrete development objectives. If you haven't currently created them during your preparation, produce a collection of vital performance indicators as well as turning points for your nonprofit.

Getting The Palau Chamber Of Commerce To Work

Resources on Beginning a Nonprofit in numerous states in the United States: Starting a Nonprofit Frequently Asked Questions 1. Just how a lot does it set you back to begin a nonprofit organization?

Some Known Facts About Palau Chamber Of Commerce.

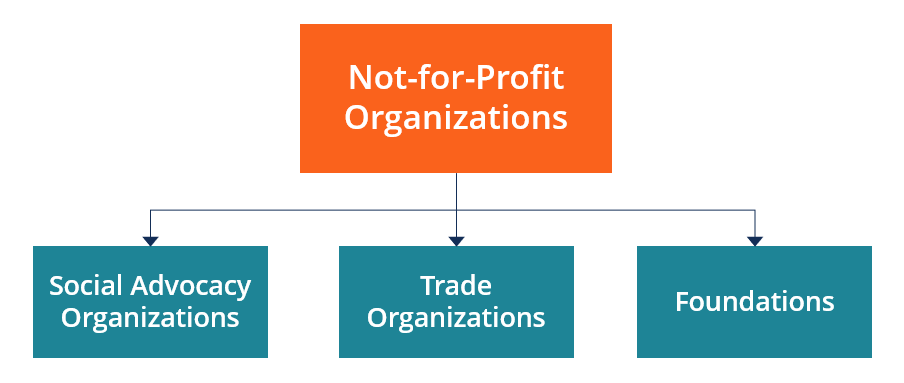

With the 1023-EZ type, the handling time is usually 2-3 weeks. Can you be an LLC and also a nonprofit? LLC can exist as a not-for-profit minimal liability company, nevertheless, it must be entirely possessed by a solitary tax-exempt nonprofit organization.What is the difference between a foundation as well as a not-for-profit? Structures are typically funded by a family or a company entity, but nonprofits are funded through their incomes as well as fundraising. Foundations typically take the cash they began out with, spend it, and also after that distribute the cash made from those financial investments.

Not known Facts About Palau Chamber Of Commerce

Whereas, the additional money a not-for-profit makes are utilized as operating expenses to money the organization's goal. Is it difficult to begin a nonprofit organization?There are a number of actions to start a not-for-profit, the obstacles to entry are reasonably few. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from government earnings tax obligations under area 501(C) of the IRS. There are specific situations where they might require to make payments. As an example, if your nonprofit makes any kind of revenue from unconnected tasks, blog it will certainly owe earnings taxes on that particular quantity.

Indicators on Palau Chamber Of Commerce You Should Know

By much the most typical kind of nonprofits are Area 501(c)( 3) companies; (Area 501(c)( 3) is the part of the tax obligation code that authorizes such nonprofits). These are nonprofits whose objective is charitable, religious, academic, or scientific.

Examine This Report on Palau Chamber Of Commerce

The lower line is that exclusive structures obtain a lot worse tax therapy than public charities. The major distinction in between personal foundations and public charities is where they obtain their economic assistance. An exclusive structure is typically regulated by an individual, family members, or firm, and obtains the majority of its revenue from a few donors and financial investments-- a fine example is the Bill and Melinda Gates Structure.

Some Known Facts About Palau Chamber Of Commerce.

This is go now why the tax obligation legislation is so tough on them. A lot of foundations just provide cash to other nonprofits. Nonetheless, somecalled "operating structures"operate their own programs. As a sensible issue, you require at the very least $1 million to start an exclusive foundation; otherwise, it's unworthy the problem and also expenditure. It's not surprising, after that, that an exclusive structure has actually been referred to as a big body of cash surrounded by individuals that want several of it.Other nonprofits are not so lucky. The internal revenue service originally presumes that they are private foundations. Nonetheless, a brand-new 501(c)( 3) company will certainly be categorized as a public charity (not an exclusive structure) when it gets tax-exempt status if it can show that it fairly can be anticipated to be openly sustained.

The Best Strategy To Use For Palau Chamber Of Commerce

If the internal revenue service identifies the not-for-profit as a public charity, it maintains this status for its very first five years, no matter the public assistance it actually receives throughout this time around. Palau Chamber of Commerce. Starting with the not-for-profit's 6th tax year, it must reveal that it satisfies the public assistance test, which is based on the assistance it gets during the existing year as well as previous four years.If a not-for-profit passes the test, the internal revenue service will certainly remain to check its public charity condition useful link after the very first five years by calling for that a completed Set up A be submitted annually. Palau Chamber of Commerce. Learn even more about your nonprofit's tax obligation status with Nolo's publication, Every Nonprofit's Tax Overview.

Report this wiki page